Medicare Options

Welcome

We do not offer every Medicare option available in your area. Currently, we represent six organizations that provide over 50 Medicare Advantage plans for you to consider. For more information on all of your Medicare enrollment options, please contact Medicare.gov, call 1-800-MEDICARE, or reach out to your local State Health Insurance Program (SHIP).

Medicare annual election period is October 15 to December 7

Original Medicare Part A

Medicare Part A may cover inpatient care in hospitals, nursing homes, and skilled nursing facilities, as well as hospice or home healthcare. When considering Medicare options, it's also important to explore Medicare Advantage plans during your Medicare enrollment period.

Original Medicare Part B

Medicare Part B may cover medically necessary services, including clinical research, ambulance services, mental health care, durable medical equipment, and some outpatient drugs. When considering Medicare options, it's important to explore Medicare Advantage plans during your Medicare enrollment period to ensure you have the coverage that best meets your needs.

Part C - Medicare Advantage

Part D - Prescription Drug Plan

Medicare Advantage plans, also known as MA or MAPD, are options that combine various Medicare coverages. These plans are typically offered as an HMO, PPO, PFFS (private-fee-for-service), or special needs plan, and may also include prescription drug coverage, making them an essential choice during Medicare enrollment.

Part D - Prescription Drug Plan

Part D - Prescription Drug Plan

Part D plans, which began in 2006 when credible drug coverage became mandatory, are an important aspect of Medicare options. It's crucial to understand that late enrollment can lead to a lifetime monthly penalty. Additionally, there are four phases of Part D coverage that beneficiaries should be aware of, especially when considering Medicare Advantage plans during Medicare enrollment.

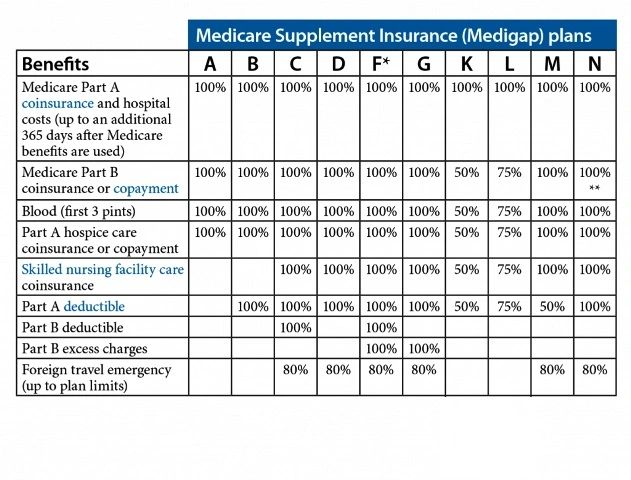

Medigap - Medicare Supplements

Medigap plans are standardized options offered by private insurance carriers that help pay for some or all of the 'gaps' in original Medicare. It’s important to note that these plans cannot be combined with Medicare Advantage plans, and understanding your choices during Medicare enrollment is essential.

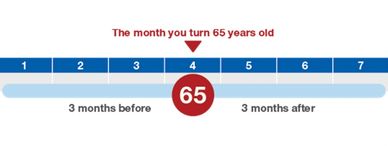

Election Periods

Election periods for Medicare enrollment may occur when you first become eligible for Medicare, during Open Enrollment periods, when there is a termination of credible coverage, qualifying for Medicaid, or if another special election period applies, depending on your Medicare Advantage plans.

2021 Medicare facts:

Part A - Hospitalization

Most people qualify for Medicare Part A (premium-free) at age 65. Understanding Medicare options is essential for navigating your healthcare needs. The hospital deductible is $1484 per benefit period, followed by $0 copay for days 1-60, $371 for days 61-90, and $742 beginning on day 91. After day 90, the lifetime benefit includes 60 reserve days. Inpatient mental health services are covered under the same terms. For those considering Medicare enrollment, skilled nursing facility stays include $0 copay for days 1-20, a $185.50 copay for days 21-100, with all costs from day 101 and beyond not covered. Additionally, hospice care is covered in full (excluding room and board), making it a crucial component of certain Medicare Advantage plans.

Part B - Medical Services

The Part B premium for 2021 is $148.50 per month (higher for some), and the deductible is $203. Once the deductible is met, you pay 20% for most covered services, while you pay $0 for home health care and Medicare-approved laboratory services. It's important to note that there is no maximum out-of-pocket limit. In addition to the services mentioned above, Part B covers preventive services such as an annual wellness exam, screenings, immunizations for flu, pneumonia, hepatitis B, and tobacco cessation counseling. When considering your Medicare options, you may also explore Medicare Advantage plans during your Medicare enrollment period to find coverage that suits your needs.

Part C - Medicare Advantage

Medicare Advantage plans are designed to provide coverage that is at least as comprehensive as original Medicare. When considering Medicare enrollment, it’s important to note that premiums can vary between different Medicare Advantage plans and carriers, and you still need to pay the Part B premiums. If your income exceeds $88,000 ($176,000 for those filing jointly), you may be subject to Part D IRMAA (income-related monthly adjustment amounts) if your Medicare options include prescription drug coverage (Part D coverage rules will apply). Additionally, it is essential to live within the service area of the chosen plan. Some Medicare Advantage plans may also offer benefits for services that are not covered by Original Medicare. Remember that these plans can have varying deductibles and maximum out-of-pocket limits.

Part D - Prescription Drug Plans (PDP)

You may not combine a PDP with Medicare Advantage plans (unless it is a private-fee-for-service plan). Premiums for these plans vary, and individuals with an income over $88,000 ($176,000 for joint filers) are subject to IRMAA. PDPs may have a deductible, which cannot exceed $445.00. To enroll in a specific plan, you must reside within its service area. The formularies of these plans list covered drugs by tiers, which may or may not be subject to the deductible. Tier one drugs typically have the lowest copayment, usually consisting of generic medications, while your costs will increase with each tier. PDPs feature four coverage phases during Medicare enrollment: deductible, initial coverage, coverage gap (often referred to as the donut hole), and catastrophic coverage within each calendar year. Understanding these Medicare options is essential for making informed decisions.

Original Medicare does not cover:

Routine foot care, hearing aids (and exams), long-term or custodial care, cosmetic surgery, acupuncture, dentures (and most dental care), and eyeglasses (and fitting exams) are important services to consider when exploring Medicare Advantage plans during your Medicare enrollment. Understanding your Medicare options can help you access these essential healthcare services.

Medigap coverage guidelines Chart

Additional Information

Plans F and G also provide a high-deductible option in certain states, which is one of the Medicare options available. With this choice, you are responsible for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,370 before your policy begins to pay.

It's important to note that Plans C and F are not available for individuals who become newly eligible for Medicare enrollment on or after January 1, 2020. Additionally, some states only offer Medigap plans to those aged 65 and older or have alternatives to the plans listed in the chart.

For Plans K and L, once you reach your out-of-pocket yearly limit (K - $6,220, L - $3,110) and fulfill your yearly Part B deductible, the Medigap plan will cover 100% of the services for the remainder of the calendar year.

Plan N covers 100% of the Part B coinsurance, except for a copayment of up to $20 for certain office visits and a copayment of up to $50 for emergency room visits that do not lead to inpatient admission.

Request to be contacted

Permission to be contacted:

Please let us know how you would like to be contacted regarding your Medicare Advantage plans (phone, email, Skype, etc.) and the best day and time to reach you. You are under no obligation to make any purchase or provide any health-related information during your Medicare enrollment process. Rest assured that any personal information provided is kept secure in compliance with Federal Regulations while we explore your Medicare options.

Matrix Insurance Brokers

7829 West Coolidge Street, Phoenix, Arizona 85033, United States

(520) 595-5095 or toll-free (888) 889-2611

Hours

Today | Closed |

Copyright © 2021 Matrix Insurance Brokers - All Rights Reserved.

Matrix Insurance Brokers is not connected with or endorsed by any of the carriers listed on this website or the Centers for Medicare & Medicaid Services (CMS). All of our agents are licensed by individual State department of insurance or other required regulatory agencies. Filling out any forms on this site is optional. By submitting information via a contact form, you acknowledge a licensed insurance agent may contact you by phone or email to discuss Medicare Advantage Plans, Medicare Supplement Insurance or Prescription Drug Plans. For all meeting requests, if you require special accommodations, please notify us prior to the meeting.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.